Tax-Loss Harvesting: A Quiet Bridge to Early Retirement

Most retirement calculators tell you what happens if you earn X% and spend Y. That’s helpful—but it leaves out one of the biggest forces acting on a taxable portfolio: the slow, steady friction of taxes. This post is about reducing that friction.

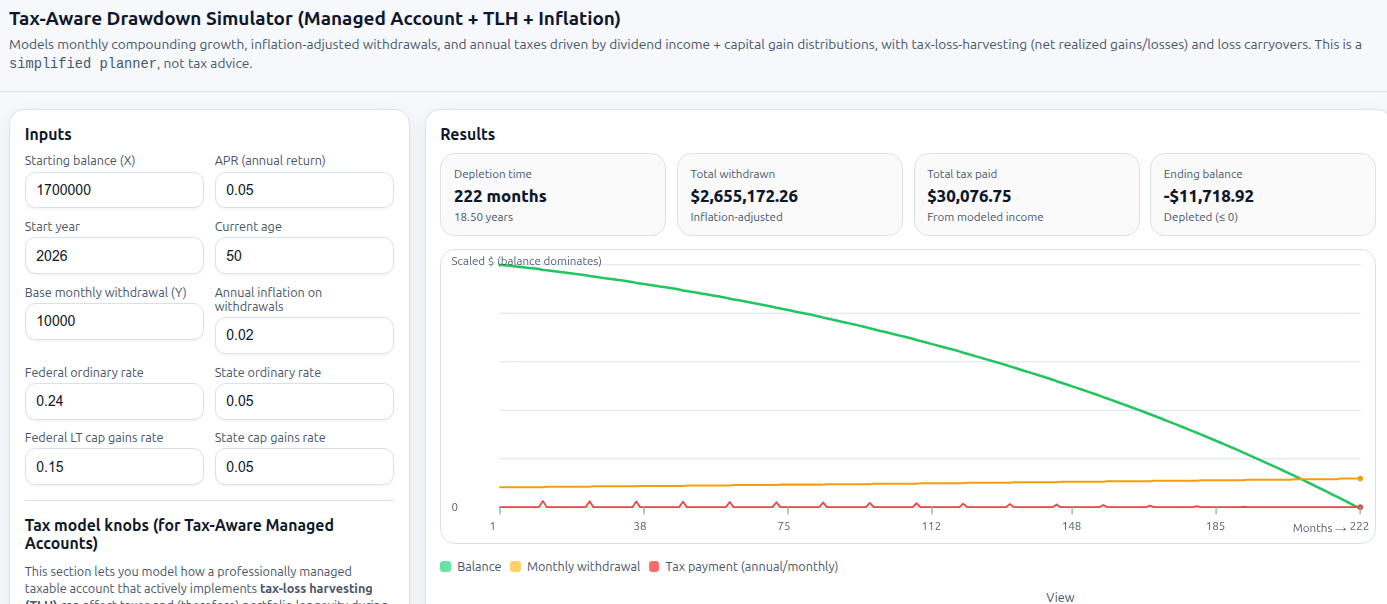

A glance at the tax-aware retirement simulator — your planning dashboard in action.

The tax-aware early retirement simulator models withdrawals, inflation, tax drag, and tax-loss harvesting effects over time.

Ready to explore your own early retirement timeline?

Launch the SimulatorCompare baseline and TLH-informed scenarios.

When people talk about early retirement, they almost always talk about a number. “What’s my FIRE number?” “How much do I need?” “What’s the safe withdrawal rate?”

Those are real questions. But if you’re trying to retire early—especially in your 50s—there’s a second question that deserves equal attention: How efficiently will your money run once you stop working?

In a taxable brokerage account, it’s not just returns and withdrawals. You also have taxes showing up every year— sometimes quietly, sometimes all at once. And over a multi-decade drawdown, that “tax drag” can meaningfully change how long your portfolio lasts.

Less tax paid → smaller withdrawals → more money stays invested → longer runway.

What Is Tax-Loss Harvesting and How It Works

Tax-loss harvesting—TLH for short—is the practice of selling investments that are down, then reinvesting in similar exposures. The goal isn’t to change your long-term investment plan. The goal is to bank a realized loss that can reduce taxes.

Those harvested losses can be used to offset capital gains. They can also offset a limited amount of ordinary income each year (under current U.S. rules), and any unused losses can often be carried forward into future years.

The headline is simple: TLH can reduce the taxes you owe, which reduces the amount you have to pull from the portfolio to cover the same lifestyle.

Why Tax-Loss Harvesting Matters for Early Retirement

Retiring at 65 usually means a 20–25 year runway. Retiring at 55 can mean a 35–40+ year runway. That extra decade is where small differences start to matter. Inflation matters more. Sequence-of-returns risk matters more. And taxes matter more.

If TLH reduces your effective tax drag even modestly, it can extend the runway. That’s not marketing—that’s math. It’s also why I think of TLH as a bridge strategy. It’s not the whole plan. It’s a piece of the plan that can connect “almost there” to “ready.”

The part people don’t love to hear: minimums

Tax-loss harvesting is easiest to do systematically inside a professionally managed account (sometimes called a PMA) that’s built for tax-aware management. The catch is that these services typically have minimum investments— often around $100,000 (sometimes higher).

That doesn’t mean TLH is only for “the ultra-wealthy.” It just means the sweet spot is usually people who already have a meaningful taxable portfolio and are actively planning for early retirement. If you’re in that zone, TLH can move the needle.

Why most retirement calculators miss this

A typical retirement calculator assumes: a steady return, a steady withdrawal, and maybe a single tax percentage. But real taxable investing is messier. Taxes come from different sources, at different rates, in different timing:

- Ordinary dividends (taxed as income)

- Capital gain distributions (taxed differently)

- Realized gains or losses (from rebalancing)

- Loss carryforwards (future tax offsets)

- Tax timing (annual vs monthly)

If you’re trying to decide when you can retire early, it helps to model the system you actually live in— not the simplified version we wish we lived in.

How to use this tool to plan an early retirement date

I built a tax-aware drawdown simulator that lets you explore this in a transparent way. You can enter:

Your timeline

Start year and current age (the schedule updates year-by-year).

Your spending

Monthly withdrawals that grow with inflation (a realistic “cost of living” ramp).

Returns & assumptions

APR assumptions and guardrails so you can run conservative vs. optimistic scenarios.

Taxes & TLH behavior

Dividend yield, capital gain distributions, and a knob to model net realized gains/losses.

Then you can ask the question that actually matters: What happens to my timeline if taxes are lower?

This is the point where the tool becomes more than a calculator. It’s not just “how long until zero.” It’s a way to explore retirement optionality. You can shift the start year, test different withdrawal amounts, and see how sensitive your plan is to tax efficiency.

The takeaway

Tax-loss harvesting won’t magically change the market. It won’t eliminate taxes. And it doesn’t replace the basics: save consistently, diversify, keep costs reasonable, and don’t overreach.

But if you’re already near the early retirement line, TLH can be a legitimate lever—one that helps reduce friction, preserves capital, and extends your runway.

In early retirement planning, sometimes the difference between “two more years” and “I’m ready” isn’t a huge market return. It’s a handful of small, disciplined advantages stacking up over time.

Ready to explore your own early retirement timeline?

Launch the SimulatorCompare baseline and TLH-informed scenarios.

Frequently Asked Questions

What is tax-loss harvesting?

Tax-loss harvesting is selling investments at a loss to offset taxable gains and reduce overall tax liability, then reinvesting in similar assets to maintain exposure.

Can tax-loss harvesting help me retire early?

For taxable portfolios over multi-decade horizons, reducing tax drag can extend portfolio longevity, which may make retiring earlier more achievable.

Do I need a minimum investment for TLH?

Many professional TLH services require minimums (often around $100,000), but this varies by provider and platform.

Disclaimer: This is for educational purposes and planning exploration only, not tax or investment advice. Tax rules vary by jurisdiction and change over time. If you’re considering tax-loss harvesting or early retirement, it’s worth discussing your specific situation with a qualified advisor.